How Can We Help?

Asset Journal

Asset Journal in RunHOA

The Asset Journal in RunHOA is designed to help HOA administrators manage and track asset-related transactions. This feature is particularly useful for recording adjustments such as prepaid expenses (e.g., insurance) or other asset allocations.

How to Use the Asset Journal

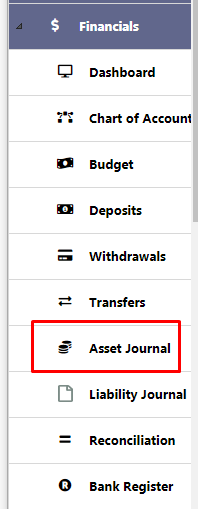

1. Accessing the Asset Journal

- Navigate to the Financials menu in RunHOA.

- Select Asset Journal from the options.

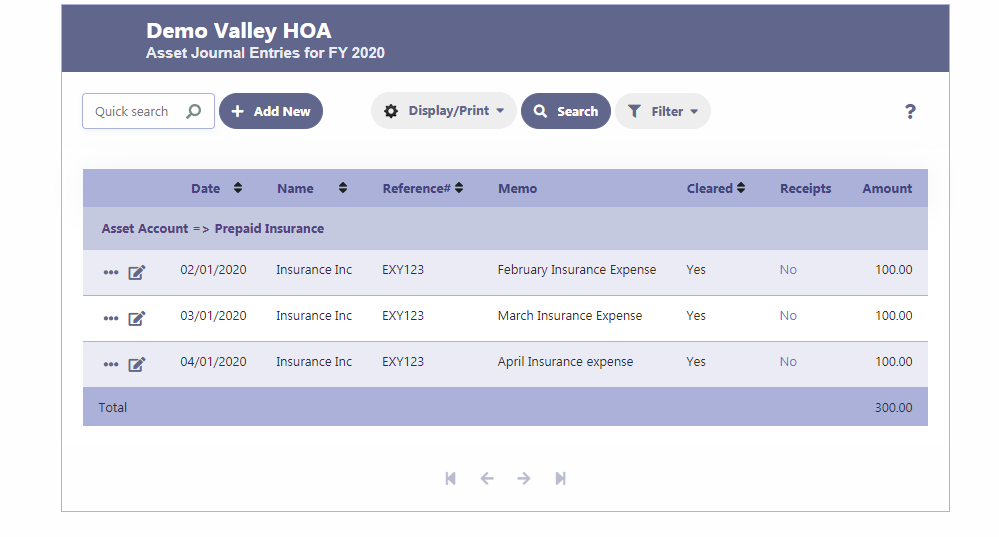

2. Viewing Entries

- The Asset Journal dashboard displays all recorded entries for the selected fiscal year.

- Key details include:

- Date of the entry.

- Name (e.g., vendor or relevant entity).

- Reference# (tracking or invoice number).

- Memo (notes about the entry).

- Amount allocated to the asset account.

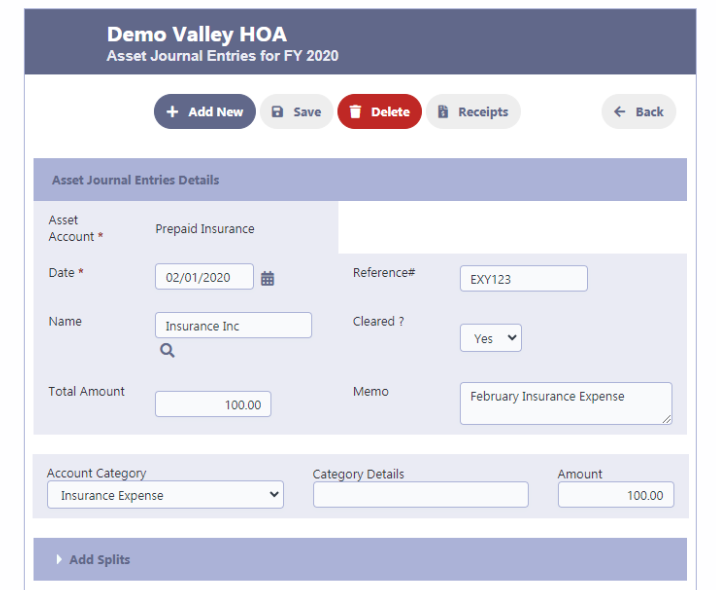

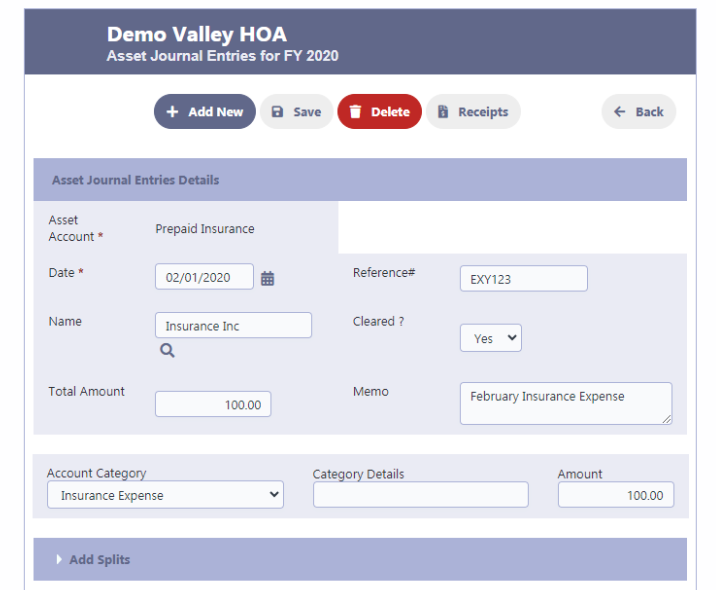

3. Adding a New Asset Journal Entry

- Click + Add New on the Asset Journal dashboard.

- Fill in the details:

- Asset Account: Select the relevant asset account (e.g., Prepaid Insurance).

- Date: Enter the transaction date.

- Reference#: Add a unique reference number (e.g., invoice number).

- Name: Enter the name of the vendor or entity related to the transaction.

- Cleared?: Indicate if the transaction has been cleared.

- Total Amount: Specify the amount associated with the asset.

- Memo: Provide details about the entry (e.g., “February Insurance Expense”).

- Account Category: Assign the appropriate expense or adjustment category.

- Category Details: Add optional details for further clarification.

- Click Save to record the entry.

4. Editing or Deleting Entries

- Use the edit icon next to any entry to make changes.

- Select Delete to remove an entry if necessary.

5. Generating Reports

- Use the Display/Print option to generate reports for all asset journal entries.

- Filter and search options help refine the data based on specific criteria.

Example: Recording Prepaid Insurance

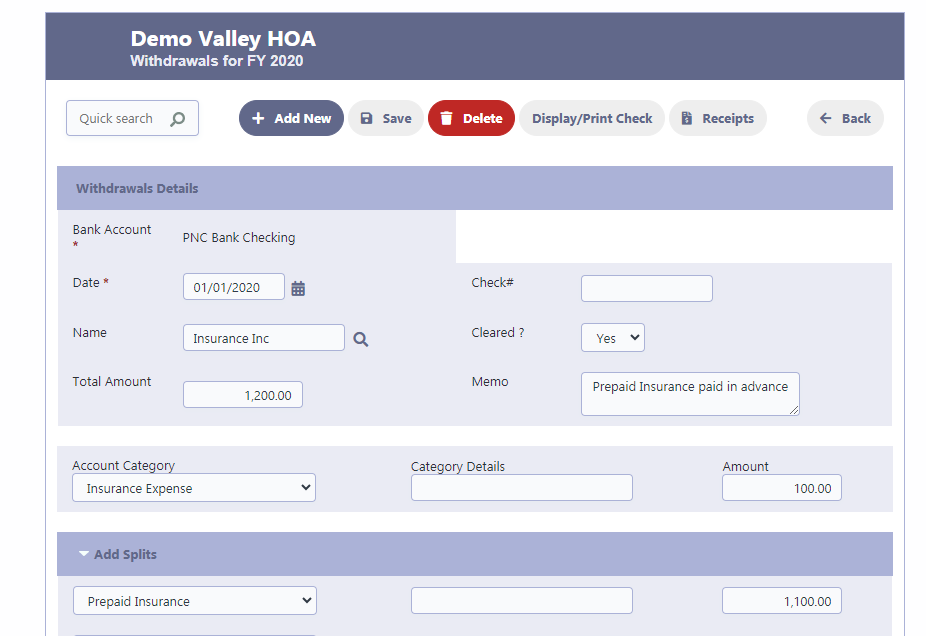

Step 1: Record the Initial Payment in Withdrawals

- Navigate to Withdrawals in the Financials section.

- Enter the details of the payment:

- Bank Account: Select the account (e.g., PNC Bank Checking).

- Date: Enter the payment date.

- Name: Specify the vendor or entity (e.g., Insurance Inc).

- Total Amount: Enter the full amount paid (e.g., $1,200.00).

- Memo: Add a description (e.g., “Prepaid Insurance paid in advance”).

- In the Account Category section:

- Split the total amount between:

- Insurance Expense: Enter the portion for the current month’s expense (e.g., $100.00).

- Prepaid Insurance: Enter the remaining balance as an asset (e.g., $1,100.00).

- Split the total amount between:

- Save the withdrawal.

This step ensures the payment is recorded, with part of it allocated to the expense and the rest to the Prepaid Insurance account.

Step 2: Adjust Prepaid Insurance Monthly in the Asset Journal

- Navigate to Asset Journal in the Financials section.

- For each month, create a journal entry to adjust the Prepaid Insurance account:

- Click + Add New.

- Select Prepaid Insurance as the asset account.

- Enter the Date for the adjustment.

- Add a Reference# (e.g., invoice number).

- Specify the Name (e.g., Insurance Inc).

- Enter the Amount for the monthly expense (e.g., $100.00).

- Add a Memo (e.g., “February Insurance Expense”).

- In the Account Category, select Insurance Expense and specify the amount.

- Save the journal entry.

Repeat this step each month until the prepaid insurance balance is fully allocated.

Summary

- Withdrawals: Record the initial payment and split it between Insurance Expense and Prepaid Insurance.

- Asset Journal: Adjust the Prepaid Insurance account monthly by allocating the appropriate amount to Insurance Expense.

This process ensures accurate tracking of prepaid expenses and aligns them with their respective periods.