How Can We Help?

How to handle Overpayments

Overview

When a homeowner overpays their account, RunHOA provides a systematic way to handle the overpayment by recording it as a liability and issuing a refund if necessary. Below is a step-by-step guide using an example where the assessment is $300, the homeowner pays $350 (overpaying by $50), and the $50 is later refunded.

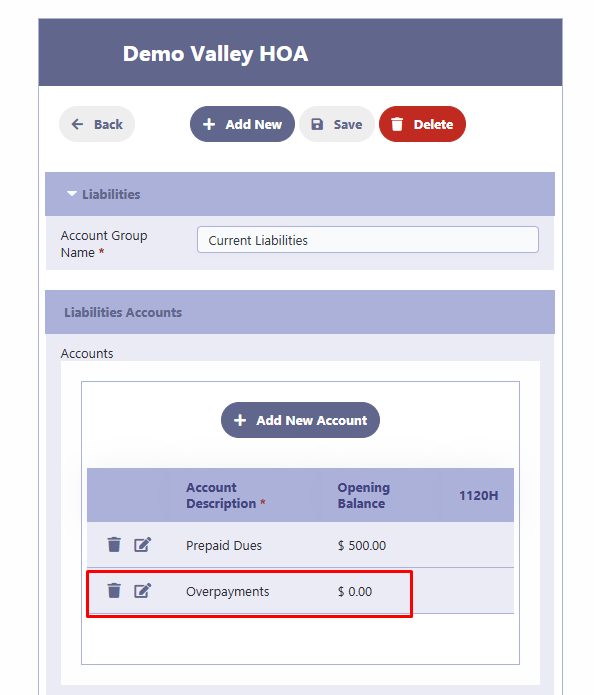

Step 1: Create a Liability Account for Overpayments

- Check Existing Accounts:

- Navigate to the Liabilities section in RunHOA.

- Look for an account named “Overpayments” under “Current Liabilities.”

- Add a New Account if Needed:

- If “Overpayments” does not exist, click Add New Account.

- Account Description: Enter “Overpayments.”

- Opening Balance: Set it to $0.

- Click Save to create the account.

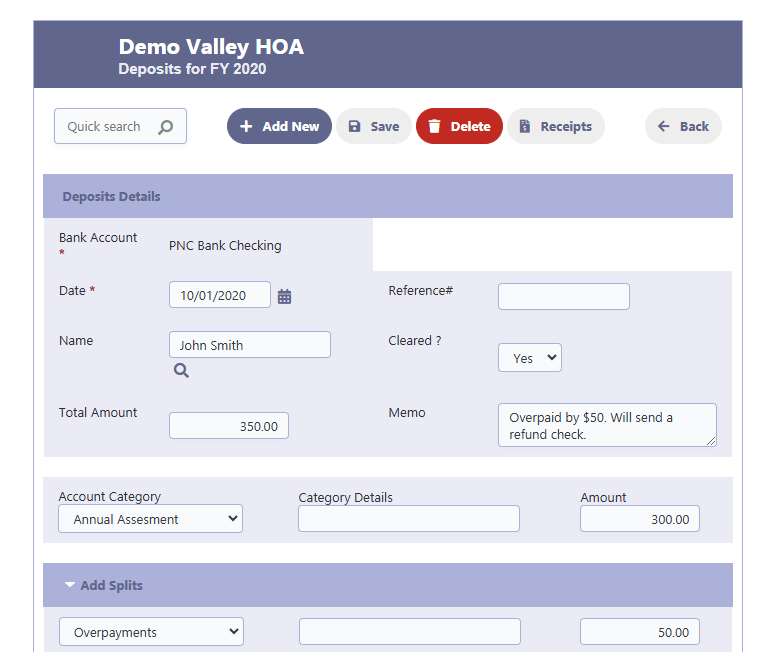

Step 2: Recording the Overpayment

- Go to the Deposits Module:

- Navigate to the Deposits section in RunHOA.

- Enter Deposit Details:

- Bank Account: Select the appropriate bank account (e.g., PNC Bank Checking).

- Date: Enter the date of the payment.

- Name: Select the homeowner who made the payment (e.g., John Smith).

- Total Amount: Enter the total payment amount (e.g., $350).

- Memo: Add a note (e.g., “Overpaid by $50. Will send a refund check.”).

- Allocate the Payment:

- Account Category: Select the assessment category (e.g., Annual Assessment).

- Amount: Allocate $300 to the assessment.

- Add Splits:

- Category: Select “Overpayments.”

- Amount: Enter the overpaid amount ($50).

- Save the Deposit:

- Click Save to finalize the deposit.

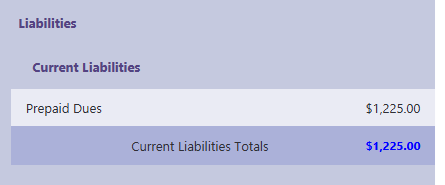

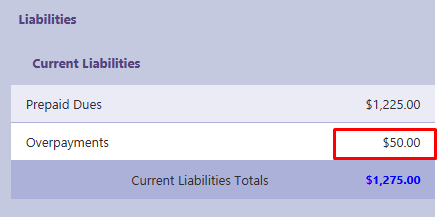

- Verify in Liabilities:

- Navigate to the Liabilities section.

- Confirm that the overpayment ($50) is recorded under “Overpayments” in the liability totals.

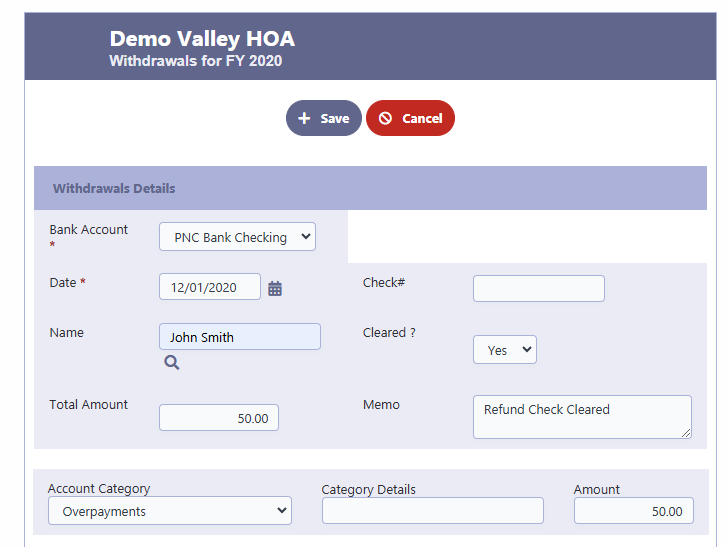

Step 3: Refunding the Overpayment

- Go to the Withdrawals Module:

- Navigate to the Withdrawals section in RunHOA.

- Enter Withdrawal Details:

- Bank Account: Select the same bank account used for the deposit (e.g., PNC Bank Checking).

- Date: Enter the date the refund check was cleared

- Name: Select the homeowner (e.g., John Smith).

- Total Amount: Enter the refund amount ($50).

- Memo: Add a note (e.g., “Refund Check Cleared”).

- Check Number: Enter the check number if applicable.

- Allocate the Refund:

- Account Category: Select “Overpayments.”

- Amount: Enter the refund amount ($50).

- Save the Withdrawal:

- Click Save to finalize the withdrawal.

- Verify in Liabilities:

- Navigate to the Liabilities section.

- Confirm that the “Overpayments” liability is now $0, and the refund has been properly recorded.