How Can We Help?

1120H Tax Form

Overview

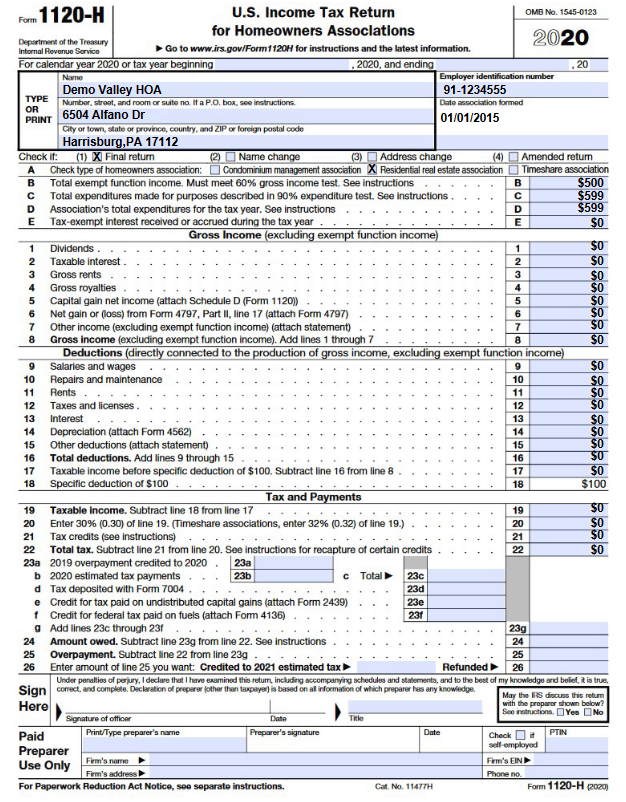

RunHOA includes a feature that simplifies the preparation and presentation of the 1120-H tax form, which is a U.S. income tax return for Homeowners Associations (HOAs). This feature is designed to streamline the tax reporting process by categorizing income and expenses according to their relevant 1120-H tax codes and automatically displaying the organization’s financial data on the 1120-H form.

Key Components

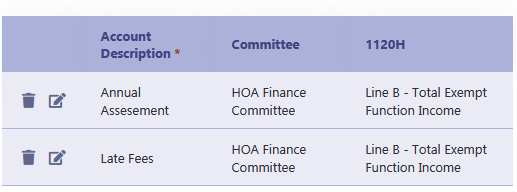

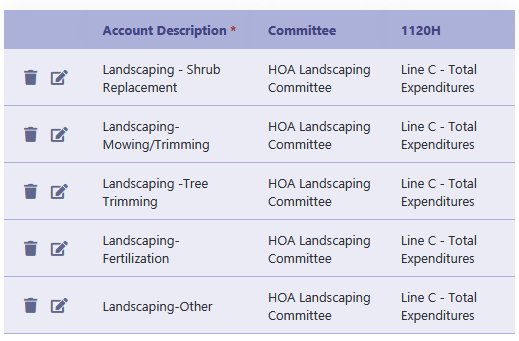

- Income and Expense Categorization: Within RunHOA’s chart of accounts, each income and expense account can be assigned an appropriate 1120-H code to ensure accurate tax reporting.

- Automated Tax Calculation: RunHOA automates the calculation of taxes, integrating financial data into the 1120-H tax form.

- Pre-filled Forms: HOA information, such as Employer Identification Number (EIN), formation date, and organization type, is pre-filled on the form.

Using the 1120-H Tax Form Feature

- Categorization: Assign the correct 1120-H code to each income and expense account in the chart of accounts.

- Running the Report: Activate the 1120-H form feature within the Finance Module to generate the form.

- Review and Edit: Check the pre-filled form for accuracy and completeness, making edits where necessary.

- Finalization: Use the automatically calculated and displayed data to finalize the tax return for submission.

How to Categorize Income and Expenses

- Navigate to the chart of accounts in the Finance Module.

- Select the account you wish to categorize and assign the corresponding 1120-H tax code from the provided list, ensuring it matches the type of income or expense.

How to Run the 1120-H Form

- Access the 1120-H form from the Financials section.

- The system will automatically calculate the taxes based on the categorized accounts and display the data on the 1120-H form.

Reviewing the 1120-H Form

- Verify that the EIN, date association formed, and organization type are correct.

- Ensure that income and expense figures are accurately reflected in the corresponding lines of the form.

Tips for Effective Use

- Consistent Categorization: Make sure all transactions are categorized consistently for accurate tax reporting.

- Regular Review: Periodically review the chart of accounts to ensure that all new accounts are properly assigned a 1120-H code.

- Stay Informed: Keep updated with the latest tax regulations to ensure that the correct codes are being used.

The 1120-H tax form feature in RunHOA is designed to assist HOAs in efficiently preparing their tax returns, ensuring compliance with tax laws, and reducing the complexity of tax preparation.