How Can We Help?

How is an additional payment handled when the check amount exceeds an existing invoice(s) in RunHOA?

Q: What happens if a homeowner submits a check for $300, but there is only a $250 invoice?

A: When a homeowner submits a check for an amount greater than the existing invoice, such as $300 for a $250 invoice, the difference (in this case, $50) is often due to other reasons, such as adjustments, penalties, ,additional fees or can be just overpayment.

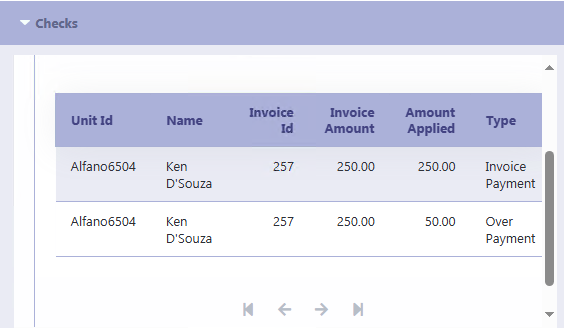

- If no adjustment fee is created, the $50 excess amount will be treated as an overpayment and applied to the current invoice. This overpayment amount will be applied to the next invoice.

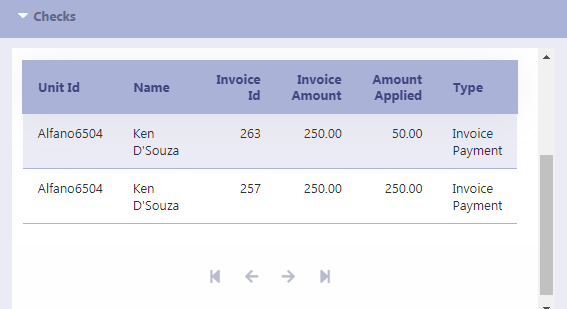

- If there is an additional existing invoice, the $50 excess payment will be automatically applied to the next invoice.

- If the excess payment is not an overpayment but is for another reason, an adjustment fee should be created. When an adjustment fee is created for the same date as the current invoice, the excess payment ($50) will be linked to the adjustment fee instead of being applied to future invoices.

This process ensures that all payments are accurately reflected and prevents the overpayment from unintentionally affecting new or upcoming invoices. The homeowner’s account will then show the $300 check completely reconciled with the $250 invoice and the $50 adjustment fee.

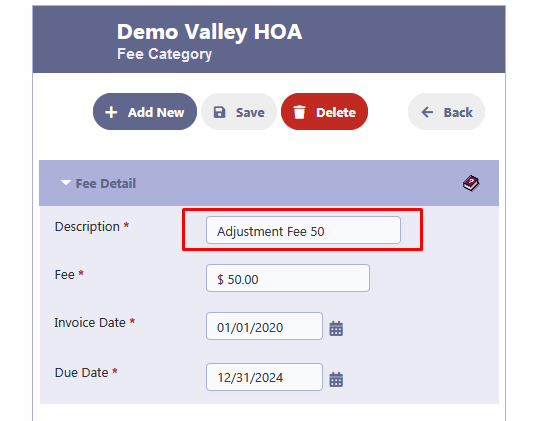

Q: Can the Adjustment Fee description be customized?

A: Yes, you can customize the description of the Adjustment Fee to provide clarity on what the additional charge represents. For example, it could be labeled as “Adjustment Fee 50.”

Q: How does this process benefit homeowners and administrators?

A:

- Homeowners can see a clear breakdown of their payments and understand how their funds are applied.

- Administrators can reconcile accounts accurately without causing confusion in future invoices.

This method ensures transparency and proper accounting practices for HOA dues and payments.